2022 overall appears promising for the construction industry in Finland according to RPT Byggfakta. The industry is prepared to capture growth opportunities with evermore focus on sustainable construction while tackling local and global challenges such as the pandemic and shortages of materials.

A look back at construction during 2021

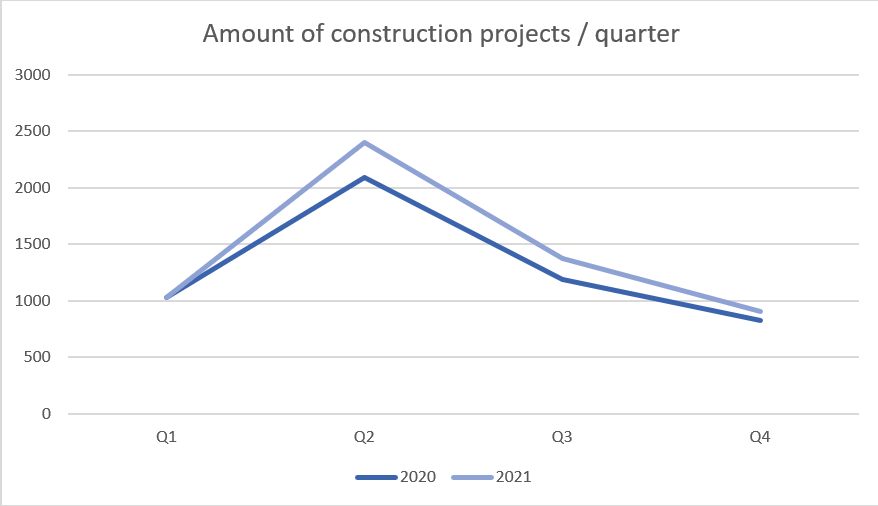

The value of the construction industry increased by 23% in 2021 in comparison to 2020. The amount of construction projects increased by 11% in comparison to the same period. The amount of new construction projects per quarter has followed the same pattern over the last two years (2021 and 2020). In the last quarter of 2021 Metsä Fibre began construction on a new bioproduct mill to Kemi. The total value of the project is €1.6 billion and it is the largest investment ever made by the Finnish forest industry in Finland.

Q1 2022 Construction Industry Overview

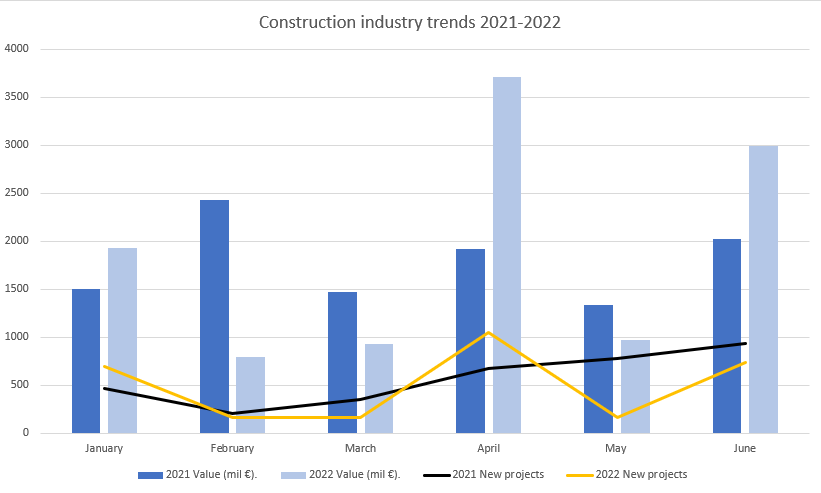

The amount of new construction projects during Q1of 2022 is on the same level as Q1 of 2021. However, the value of new construction projects is forecasted to decrease by 32% in comparison to Q1 2021.

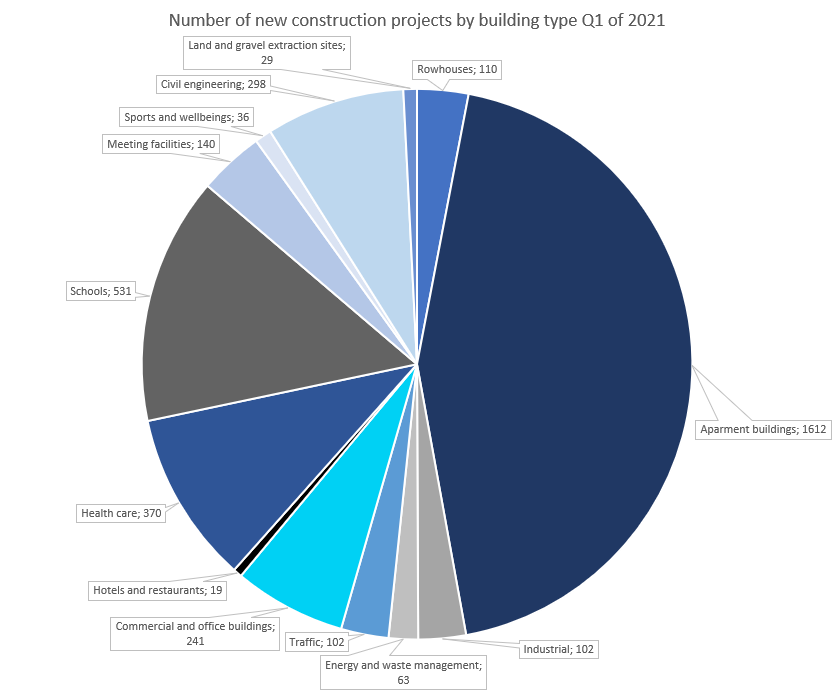

New apartment building construction projects are significant in value- around 1.6 billion € during Q1 of 2022. However, the value sees a slight decrease compared to Q1 of 2021. When looking at the total value of projects by construction building type, the value of new apartment building projects accounts for 44% of all construction in Finland.

The value of construction increases the most in assembly facilities (103%) and school construction (73%) in comparison to Q1 2021.

Below is a list of some of the largest projects starting in Finland during Q1 (value over 25 mil. €):

- Northern Ostrobothnia Hospital District’s OYS Hospital of the Future 2030 (€130 million)

- Renovation of the Finlandia hall (€122 million)

- Tramway from Kalasatama to Pasila (€79 million)

- TYKS Psychiatric Hospital Phase 1 (€60 million)

- TYKS Salo hospital project (€58 million)

- Wintter Education and Welfare Center in Uusikaupunki (€58 million)

- New multi-space office at Kielotie 13 constructed by VTV Kiinteistöt (€58 million)

- Newil & Baun’s Meander apartment complex (€50 million)

- Sawmill in Kärkölä by Koskisen Oy (€48 million)

- KYS Psychiatric House in Kuopio (€42 million)

- Lapinmäentie 1 renovation by SRV Rakennus (€40 million)

- Kemponkylä multipurpose building in the municipality of Kempele (€39.5 million)

- Aparments Kanavansilta in Tampere by YIT (€30 million)

- Aparments Helsingin Paratiisilintu constructed by JM Suomi (€25 million)

2022 Construction Industry Forecast

New construction projects are predicted to commence at a more accelerating rate after a moderate first quarter of 2022. The value of construction during January-March is clearly lower than in the corresponding period last year, but large-scale projects are planned to start in April-June. The estimated value of new construction projects during Q2 of 2022 is around eight billion euros.

Growing trends

The strongest trend in construction building types is apartment buildings. Housing construction is growing extensively throughout Finland, even outside larger growth centers. The amount of smaller residential construction projects is also on the increase. The number of apartments constructed for sale are largely increasing, while rental housing production is set to decrease.

The share of public construction form total construction has fallen steadily while private construction increases. Warehouse construction is also clearly growing- partly due to the trend of online businesses, which require warehouse functions for their services. The value of industrial construction has decreased by 94% in Q1 of 2022 compared to Q2 2022- this large decrease is partly due to the large bioproduct mill project in Kemi, which started in 2021. Without this project, the decrease of value in industrial construction would still have been 60%. However, going forward in 2022 economic growth is expected to accelerate industrial construction and the industry in investing heavily in new construction. Export growth is also forecasted to accelerate faster this year in comparison to the previous year. Warehouse and industrial construction is expected to grow to be the largest construction building type in Finland by cube meter after apartment buildings during 2022.

Another strong trend in the industry is new construction projects (rather than renovation projects). The value of new construction projects during Q1 is excepted to be €2573 million while the value of renovation construction is expected to be €1079 million. The renovation construction industry has had three weak years in Finland due to uncertainty caused by the pandemic- but this year renovation construction is also expected to grow moderately. Particularly repairs of residential buildings are expected to accelerate- for example through pipework and sewage system renovations in blocks of flats built in the 1960s and 1970s. Renovations to business facilities are still typically on hold because of the uncertainty on the more permanent changes caused by the pandemic.

Declining trends

The share of commercial and office buildings from all construction building types has remained very stable for two years, however, overall the amount of new commercial and office construction projects has been declining. Hotel and restaurant construction projects see a 77% decrease in their share of value of new construction projects in Finland. Agricultural construction continues to decline.

Some construction projects are likely to be postponed due to the certain level of uncertainty in the industry caused by the pandemic. Covid-19 has mainly been visible in the construction industry though project start dates being postponed, but overall the annual amount and value of construction projects has been on an increase.

Below is a list of the largest construction projects starting in Finland during 2022 (value over €100 million):

- Laakso Joint Hospital (€838 million)

- Helsinki Garden (€800 million)

- Keliber’s Lithium Mine (€350 million)

- Wasa Station multifunctional complex (€200 million)

- Roihupelto Campus (€176 million)

- Ferry Terminal Turku (€172 million)

- Hippos 2020- project (€170 million)

- Aspnäs hybrid building (€160 million)

- Northern Ostrobothnia Hospital District’s OYS Hospital of the Future 2030 (€130 million)

- Renovation of the Finlandia hall (€122 million)

Key players in the industry

Below we’ve listed the five project orchestrators with the highest value projects during 2021:

- City of Helsinki (€1403 million)

- YIT Suomi Oy (€986 million)

- Kiinteistöosakeyhtiö Laakson yhteissairaala (€838 million)

- Projekti GH Oy (€800 million)

- SRV Rakennus Oy (€456 million)

Largest structural design/engineering companies in Finland by value of projects in 2021:

- A-Insinöörit Suunnittelu Oy (€2274 million)

- Sweco (€1952 million)

- Pöyry Finland Oy (€1210 million)

- Sitowise Oy (€1201 million)

- Ramboll Finland Oy (€1074 million)

Largest electrical design companies in Finland by value of projects in 2021:

- Granlund Oy (€1251 million)

- Rejlers Finland Oy (€992 million)

- Ramboll Finland Oy (€938 million)

- Sitowise Oy (€789 million)

- Sweco (€757 million)

Largest main contractors in Finland by value of projects in 2021:

- YIT Suomi Oy (€4737 million)

- SRV Rakennus Oy (€2824 million)

- Skanska Talonrakennus Oy (€2643 million)

- Lehto Tilat Oy (€2019 million)

- RKC Construction Oy (€1758 million)

The verdict

Overall 2022 seems appears encouraging for the construction industry in Finland. Covid-19 has had a relatively low impact on construction. In addition low interest rates and the high consumer confidence index provide a solid basis for growth. Shortages of materials, equipment and labor will continue as the biggest challenges for the industry. Rising construction material costs will be the single biggest threat for companies and completing cost calculations for projects will remain challenging. In addition, 33 percent of construction companies in Finland estimate, that shortage of skilled labor will be their biggest barrier for production. Rates of employment in the sector are expected to grow. The pace of growth is expected to slow down in 2023- so the construction industry should now focus on utilizing the most of the opportunities, that the marketplace has to offer.

Want to discuss the topic further?

Veera Huovinen

Project Supply Chain Specialist

email: veera.huovinen@loginets.com

phone: +358 40 934 5189