To say that a majority of the world’s population has been directly affected by the global supply chain crisis would be an understatement; it’s hard to see how someone in the world — irrespective of where they live — would not have felt the impact of soaring prices, delivery delays and unpredictable outlooks.

Amidst rising inflation and Russia’s invasion of Ukraine, the problems have only compounded — that much is a certainty. While a singular reason for the supply chain crisis cannot be determined, it is clear the woes have been affected primarily by the COVID-19 pandemic, global trade issues and geopolitical instability. In itself, the crisis has also directly led to price increases and surging inflation. (Pineda 2022) The biggest question, however, is when and how we will get out of this predicament and what the future will look like.

As it is highly likely that the crisis continues well into 2023 (Gren 2022; Migliaccio 2022; Goodman 2022) we wanted to find some of the most common predictions for what the primary logistical challenges and trends will be in 2023, how they will affect us and how we can best navigate through them.

1. Uncertain Freight Costs

In an aptly named piece, Reuters (2021) talks about the supply crisis akin to “Containergeddon”. This name is hardly off the mark, as it’s highly likely the visual image one would conjure if talking about the supply crisis is that of containers. Popular news stories, such as huge cargo ships waiting off the coast of California (Berglund 2022) due to a congested port, would only have served as a tool to etch this image into our consciousness.

As roughly 90 percent of the world’s goods move through the shipping industry, (Baertlein, Saul & Cavale 2021) it is only natural that the crisis is as interlinked to containers as they are, and that they are the center point for the upended global supply.

Unfortunately, the prices to ship these containers have been incredulously volatile, and while they have leveled off since the peak seen last year, when prices were more than 10 times higher than in January 2020 (Fahy 2022), they are still not at the levels they were before the COVID-19 pandemic (Statista 2022).

On top of this, there is no reason to think the rates will drop back to pre-covid levels or even that schedule reliability will improve, as other supply chain problems could worsen, which in turn would affect prices. (Berglund 2022).

2. Labor Shortage

Labor is the biggest challenge across all modes of logistics and transportation right now. Finding and retaining enough employees to effectively move products along the freight network is a major worry as carriers do not have the manpower to keep up with demand. This in turn negatively affects shippers’ ability to deliver supplies and finished goods on time. (Tranausky 2022) Despite some companies moving to increase wages and working conditions for drivers and factory workers, these changes have been slow to take effect. Consequently, there is currently no sign that carriers are moving out of this difficulty anytime soon. (Tranausky 2022; CTSI 2022)

If the role of one critical segment in the the workforce has been highlighted due to labor shortage, it is that of truckers. Despite being one of the most essential jobs in the world, trucking has struggled to gain enough workers to maintain demand; nor will driver retention ease up anytime soon, contrary to the hopes of many economists. (Berger 2022; CTSI 2022) In dire predictions, the American Trucking Associations expects the trucking industry is short 80,000 drivers at the moment, and will be short 160,000 drivers in the next ten years (ATA 2022). Unfortunately, warehouse operations and manufacturing facilities also face similar issues. (Berger 2022)

Much of the current labor shortage arises from a cultural shift, which takes time to settle. The available workforce must gain a better perception of supply chain work, and organizations must establish themselves as better, more equitable employers. These changes are important, but they won’t happen overnight. (Berger 2022)

3. Port Congestion

Port congestion has plagued global supply chains through 2020, 2021 and the beginning of this year, particularly in the US and Asia. At U.S. ports, ships have been stalled for an average of seven days since the start of 2022. That’s a four percent increase over the last year and a 20 percent increase since 2020. (Goodman 2022)

While previous evaluations feared that it could likely worsen during the peak shipping season, the most dire situations now seem to have been averted. This is because earlier estimates that port congestion would grow and persist until it would ease in the start of 2023, (JMR 2022), can now be backed up by more recent data that show a return to normality in terms of port congestion could be possible by March 2023. (Shipping Australia 2022.) That being said, while the proportion of the global boxship fleet unavailable due to port delay has dropped to 7.9% from a peak of 13.8% in January 2022, (Shipping Australia 2022) it is still way above pre-COVID levels (Maritime Executive 2022).

However, to wish for no new supply chain disruptions may, alas, be futile, as DHL (2022) reports that “while port congestion is easing across Asia and North America, and volumes have started to shrink after last year’s cargo boom, new disruptions to the supply chain are already underway”.

4. Lack of Data and Analytics

Out of all the current supply chain trends, data is currently the most important one and will be the longest-lasting (Eira 2022). It is hardly surprising that data would be an integral part in a supply chain in today’s digitized world, but as delivery problems can lead to significant rise in costs and hurdles, it is vital that we can also track and analyze material across the entire supply chain. Leveraging analytics and data can therefore produce numerous advantages and solutions which have ease-of-use in mind.

Digitization is also increasingly common, as carriers and even government agencies are beginning to require electronic documents. As a historically paper-heavy industry, these industry trends will push companies to prioritize going digital. (FWGS 2022)

While 99% of 3PLs (Third-party logistics companies) agree that analytics is a necessary element of 3PL expertise, only 27% of 3PLs are actually satisfied with their current analytic capabilities. It’s a major issue that impacts logistics planning, identifying cost leakages, benchmarking KPIs, analyzing delivery failure reasons, and more. (Reuters 2019)

The shortage of labor may also mean that while labor issues persist, supply chain organizations may have to rely more heavily on automation. (Berger 2022) Naturally, a reliable platform and reliable data is required to run these automations. Technology that prioritizes data and visibility will be incredible sought-after in 2023, since incorporating strategic technologies can enable supply chain managers to optimize supply chains from end to end (FWGS 2022).

As the logistics and supply chain ecosystem move towards deeper technology integration and advanced computing, digitization across the entire supply chain is important beyond compare. Investing in smart logistics platforms that offer advanced data analytics and also report highly actionable data visualizations, is therefore going to become a business imperative. This also means that partnering with the right service providers for the right technology at the right time is now essential.

5. Integrations

To succeed in the digital economy, organizations must manage the integration of business, technology, people, and processes not only within the enterprise but also across extended enterprises. Supply Chain Management (SCM) systems facilitate inter-enterprise cooperation and

collaboration with suppliers, customers, and business partners. (Nassan & Awad, 2010) Put another way, supply chain integration creates a shared ecosystem, which produces improved visibility, greater agility, more network collaboration and comprehensive risk management. (Deines 2021)

Although this system can bring benefits and competitive advantage to organizations, the management and implementation of it pose significant challenges to organizations. (Nassan & Awad, 2010)

This is important to note because the coming years will see even more components being added into the supply chain, as companies look to make partnerships and build integrations with third parties. Partnering up with third-party services is an especially alluring option, as they can help companies reduce costs while improving customer service. (Eira 2022)

For instance, integrations are particularly useful for shippers who often use a combination of sea and land transportation for their products. With integrated services delivery times become shorter, freight costs can decrease and customer service can improve. (Eira 2022)

Companies will always aim to streamline and optimize their supply chains as much as possible. As a result, more supply chain managers will be partnering up with third-party logistics providers (3PLs) and 3PL-based technologies. Companies will also want to seek partnerships with other businesses that specifically incorporate digital solutions, as they can deliver more accurate delivery ETA estimates and cut down on administrative work. (Eira 2022)

With an extensive network of shipments and deliveries, any flaw that occurs in any region can directly affect the delivery time of all the orders. (Neves 2021) It is therefore imperative that all parts of the supply chain can co-operate seamlessly and with the utmost ease.

Solutions

It is safe to say that the disruption to the supply chain naturally has everyone’s attention. The current situation is not permanent, however, and the pandemic-induced bottlenecks in the system will eventually resolve themselves. Hence, it is prudent to contemplate the nature of the outlook for 2023 and beyond right now, especially since some shippers are already negotiating freight contracts stretching for both two and three years into the future. (Jensen 2022).

Freight Price

In terms of the price of freight, while more vessels could be added to the global fleet next year, this does not mean that freight rates will drop broadly as it depends on how ship carriers allocate increased vessel capacities, (Lerh 2022) and how they optimize that allocation. If everything runs smoothly, prices will be optimized.

Port Congestion

To alleviate port congestion and lack of precise ETAs (estimated time of arrival) due to unreliable transportation, businesses can better deal with this challenge with the assistance of a material management system. Such a system would provide organisations with real-time data which means businesses would be aware of their shipments and can be alerted to any potential disruptions and delays immediately. This way, they can take the appropriate measures to minimise the impact. (Lin 2022)

Visibility and Integration

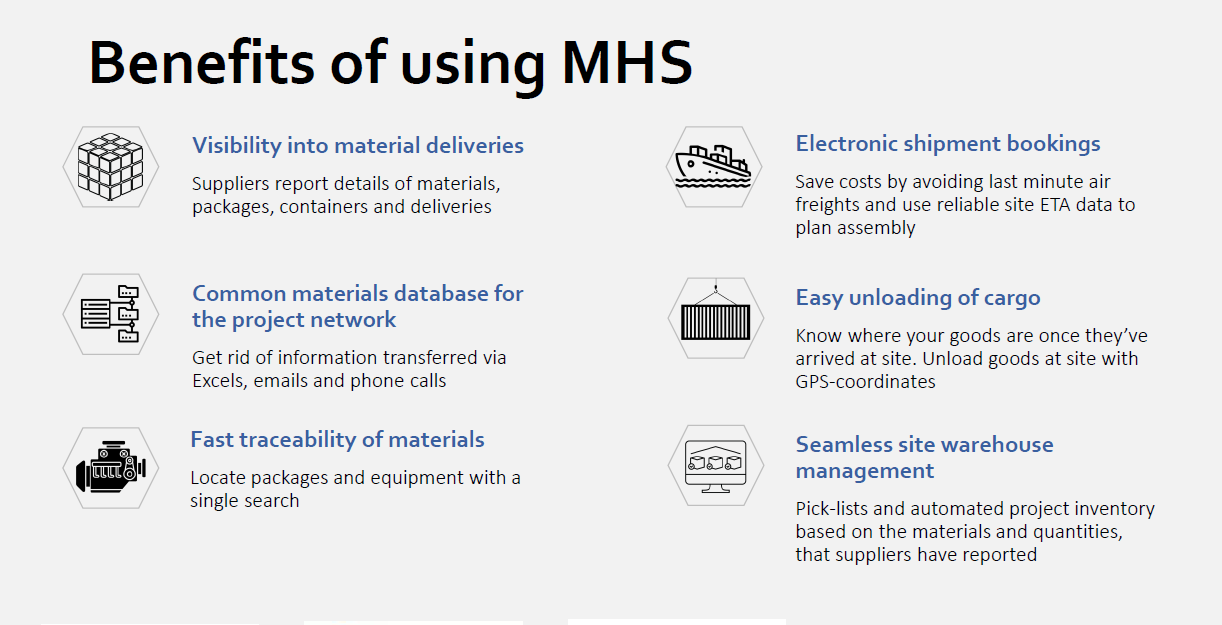

Similarly, to address the lack of visibility in the supply chain process, an efficient material management system would provide companies with an all-encompassing view of their various in-transit shipments from different sub-contractors and forwarder performances globally.

The best software solutions for visibility also integrate multiple management systems, like warehouse management systems and enterprise resource planning tools. This helps supply chain managers to optimize supply chains from end to end. In fact, being able to track materials and get supply chain data and visibility can benefit almost every aspect of a business, including meeting customer demands and improving the bottom line – even in the face of global instability.

Conclusions

The supply chain is the backbone of business operations; companies must know all the activities happening in the supply chain at all stages to make sure it’s working the way it should. Unfortunately, plenty of businesses still don’t have complete visibility into their supply chains. Yes, supply chains are complex things, but advancements in technology give business owners plenty of ways to optimize them to ensure everything runs as smoothly as possible. (Eira 2022)

Investing in practical data tools has never been easier. Intuitive software that is easy to navigate and presents crucial data in an easily-understood format is essential for companies to forecast demand accurately and make better decisions to mitigate risk. (Eira 2022)

At LogiNets, we provide material management platforms with which you can easily track materials along the entire supply chain. We would love to help with your material handling questions; if you’d like to know more about our software, please click the link below.

Sources:

ATA (2022): ATA Chief Economist Pegs Driver Shortage at Historic High | American Trucking Associations

Banker (2022): Top Supply Chain Trends Heading Into 2023 (forbes.com)

Berger (2022): 7 Challenges Supply Chain Managers Will Need to Address in 2023 – Global Trade Magazine

Berglund (2022): Container Shipping Outlook 2022-2030: Looking Beyond the Current Supply Chain Debacle (xeneta.com)

Deines (2021): Supply Chain Integration Explained: A Detailed Guide – With Vector

DHL (2022): Ocean Freight Market Update (dhl.com)

Eira (2022): 14 Supply Chain Trends for 2022/2023: New Predictions To Watch Out For – Financesonline.com

Fahy (2022): Plummeting freight rates bring relief for importers – Investors’ Chronicle (investorschronicle.co.uk)

FWGS (2022): 2023 Supply Chain Trends: What You Should Know | Flat World Global Solutions (flatworldgs.com)

Goodman (2022): A Normal Supply Chain? It’s ‘Unlikely’ in 2022. – The New York Times (nytimes.com)

Gren (2022): Global Supply Chain Crisis to Continue to 2023 – Industry Leaders Magazine

Jensen (2022): 2023 and Beyond: What to Expect for Shipping, Rates, and Deliverability (morethanshipping.com)

JMR (2022): US Port Congestion Will Continue into 2023 and More Supply Chain News (jmrodgers.com)

Ladbury: (2022): Supply chain problems could persist into 2023, warns the IMF – Commercial Risk (commercialriskonline.com)

Lerh (2022): Global port congestion, high shipping rates to last into 2023 – execs | Reuters

Lin (2022): 4 Supply Chain Challenges That Will Continue in 2023 | Cargobase

Maritime Executive (2022): Report: Chinese New Year Compounds Container Shipping Delays (maritime-executive.com)

Miggliaccio (2022): IMF Warns Europe That Supply-Chain Crisis May Drag Into 2023, Test ECB – Bloomberg

Neves (2021): Key Logistics Issues and Challenges for 2022 – Eurosender Blog

Padhi, Smit, Greenberg & Belotserkovskiy (2022): Navigating inflation: A new playbook for CEOs | McKinsey

Pineda (2022): Effects of the 2021-2022 Global Supply Chain Crisis – Profolus

Reuters (2019): New report finds major analytics gap for 3PLs and shippers | Reuters Events | Supply Chain & Logistics Business Intelligence¨

Shipping Australia (2022): Global port congestion cut in half; return to normality forecast for Q1 2023 – Shipping Australia